Mr. Popescu is an independent investment analyst and studies the gold and silver market and their future role in the international monetary system. He has followed regularly since 1970 the gold, silver and foreign exchange markets. He has a bachelor degree in physics (1993) from Concordia University in Montreal, Canada and has completed the Canadian investment management certificate (1999) of the CSI. He is a member and was the president in 2004 of the CSTA and also was president in 2005 of the Montreal CFA Society. He is a member of the CFA Institute, the MTA, NYSSA, UKSIP, the CSTA and the Gold Standard Institute International.

Let me look, in this article, at the anti-gold, the US dollar. All of a sudden, with the illusion of the end of QE, there is a strong belief that things have changed for the best for the U.S. and, more specifically, for the US dollar. All of a sudden, the US debt is gone and the deficit problem is almost solved with shale oil.

I have to admit that momentum has, all of a sudden, changed in favor of the US dollar. From a geopolitical point of view, I think the downing of the Indonesian airliner in Ukraine changed drastically, at least in the short term, the momentum in favor of the U.S. Before the incident, Europe was getting closer to Russia as the spying and other blunders by the American administration brought European leaders closer to it. All that changed after the Indonesian airliner incident in Ukraine. It was an unexpected gift to the U.S. and a major setback to Vladimir Putin’s strategy to split Europe from the U.S. However, president Putin has restrained himself in his comments to antagonize European leaders focusing his attacks on the U.S. and continuing negotiations with Europe. It is evident that he is looking for a split in the NATO alliance. Don’t count Russia and Vladimir Putin out yet, and China seems to be closer to Russia than to the U.S.

Is this the beginning of a new secular bull market in the US dollar? Some see a resemblance to the bull market started in 1980 when Ronald Reagan and the Republicans were voted in. I remember the mood in the U.S. in the last years of the Carter administration. Many of my American friends were extremely bearish on America. I remember speaking with an American couple in Montreal at the 737 Restaurant, on top of the Place Ville-Marie building, from where you can almost see the U.S. border. They were so depressed and disillusioned with their country. Americans were running away from the United States like rats from a sinking ship. It was for me a very contrarian bullish signal on the U.S., but I could not convince my American friends. We know what happened afterward. Can this be a repeat of that cycle? Some think so. I don’t. There was an illusion then that the U.S. would deal with the debt and deficit but we found out fast that the only thing changed was the type of waste. Rather than spend on civilian bureaucracy waste, Ronal Reagan and the Republicans chose military bureaucracy waste. The result was the same. The extra time gained to solve the debt/deficit problem was wasted and the U.S. finds itself today in a much worse position than in 1980.

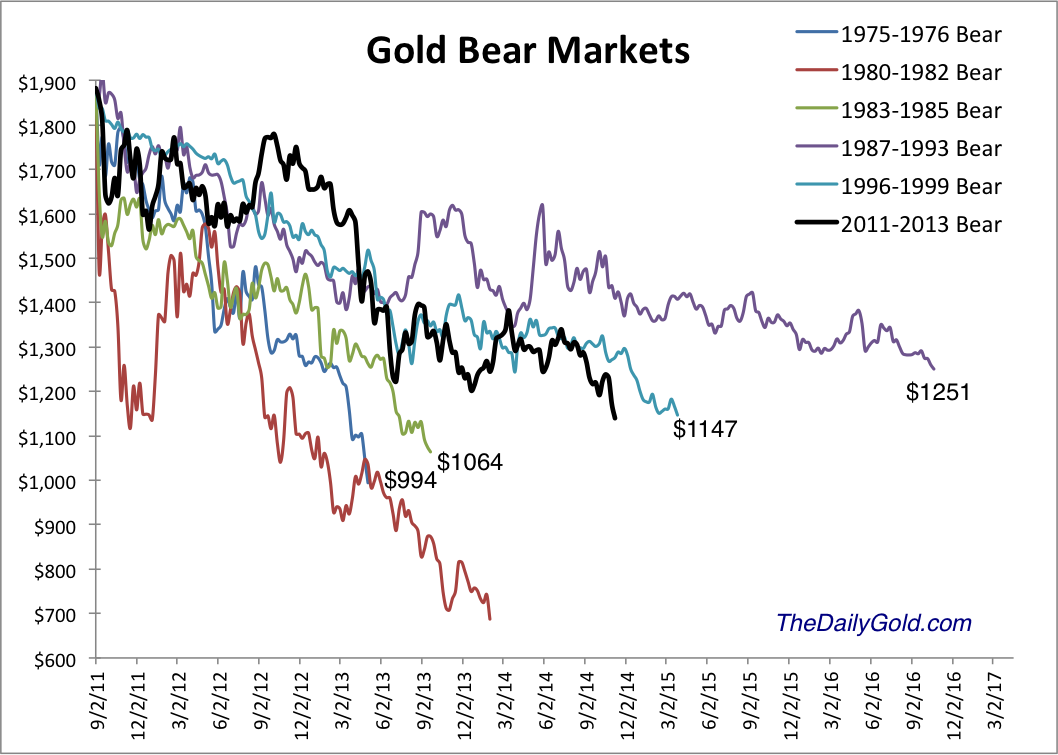

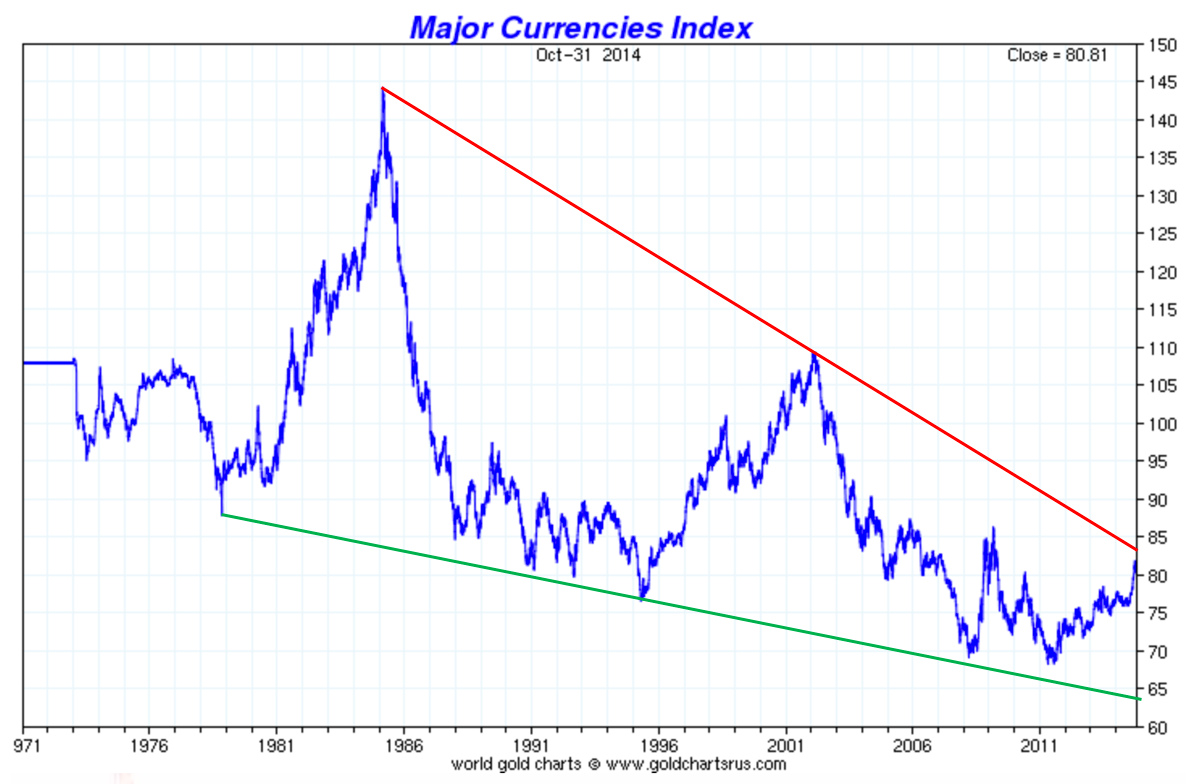

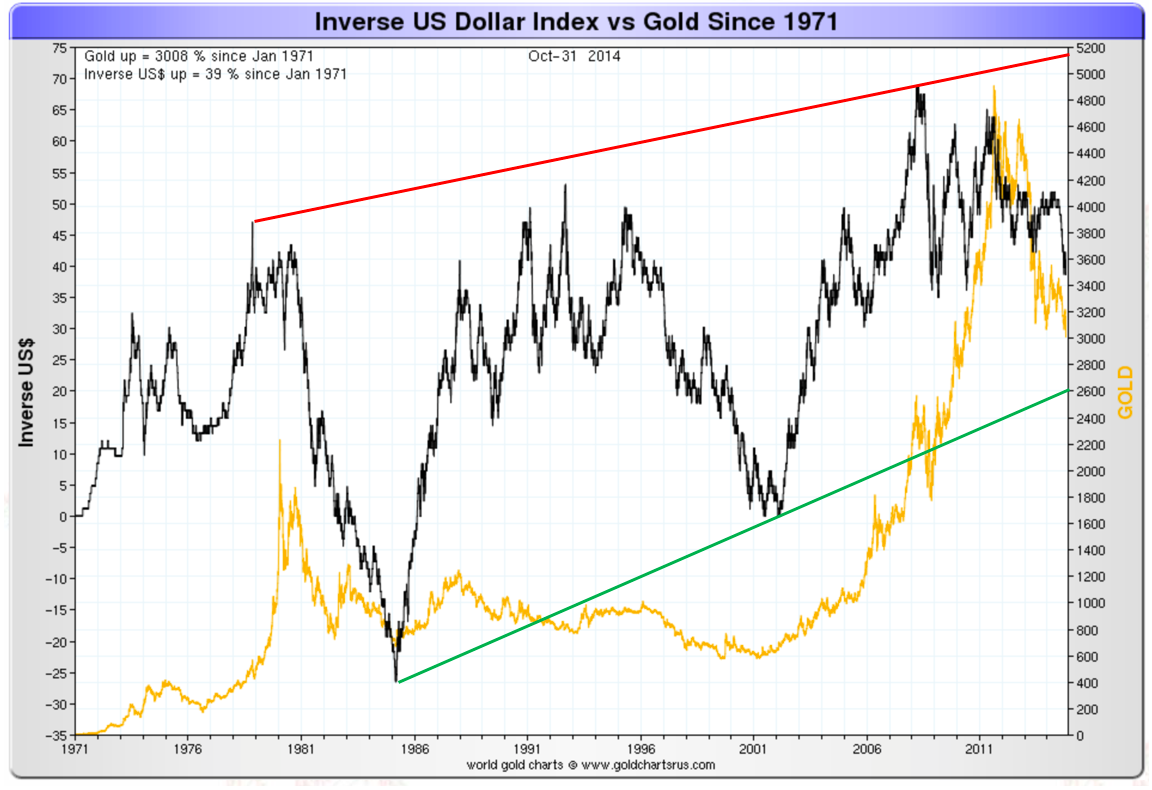

Look carefully at this major triangle formation in the chart below. You can easily observe lower lows at each bottom and lower highs at each top. I expect this trend to continue.

Chart #1: US Dollar Index

Besides, what we are witnessing now is a collapse of the fiat (paper) monetary system that has started 100 years ago, not just in 1971 with the end of the Bretton Woods gold exchange standard. Looking at a short-term chart of a seasonal storm and ignoring the possibility of a tsunami that happens every one hundred years or more is a big mistake. The US dollar is facing a tsunami, not a seasonal storm. The dismantling of the petrodollar is in progress and both China and Russia are advancing slowly but surely to replace the dollar as much as possible in international trade. A picture of only 40 years gives an incomplete and distorted image.

Two major events in the immediate future promise to shake the US dollar, gold and the international monetary system: One is the

Swiss referendum on gold reserves, but only if it is a YES vote, and the other one is an announcement by China of their actual gold reserves. The last time they did it, it was in 2009. I think the announcement is linked to the inclusion of the Yuan in the IMF’s basket of currencies called the SDR. I do not expect an announcement this year, but next year is a very strong possibility. I would not be surprised if, immediately after, Saudi Arabia also announces, as they did in 2009, an increase in their gold reserves.

Chart #2: Inverse US Dollar Index vs Gold since 1971

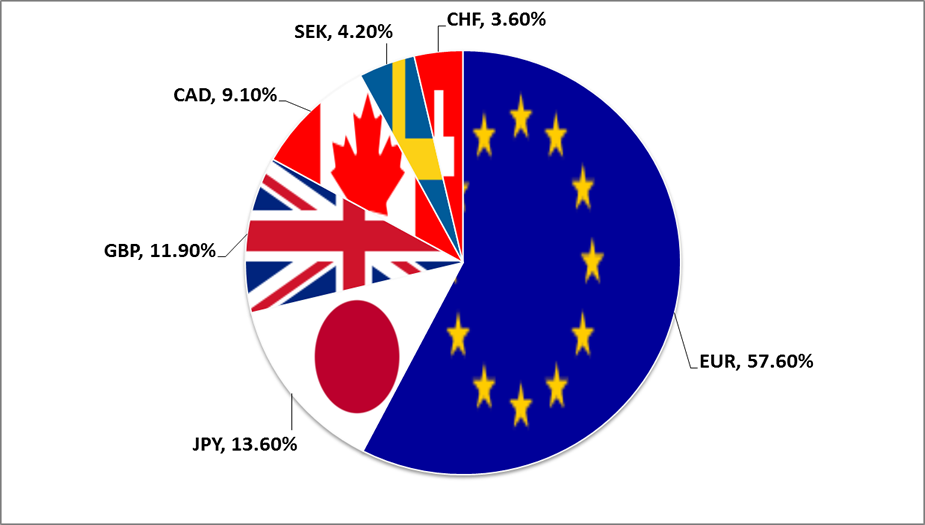

In addition, I have to caution you that since the euro introduction in 2001, the US dollar index has lost its significance, since it has become highly dominated by the euro. As you can see in the chart below, the euro represents now 57.6% and if we add the other closely related European currencies like the Swiss franc and the British pound, we get 77.3%.

Chart #3: US Dollar Index Components

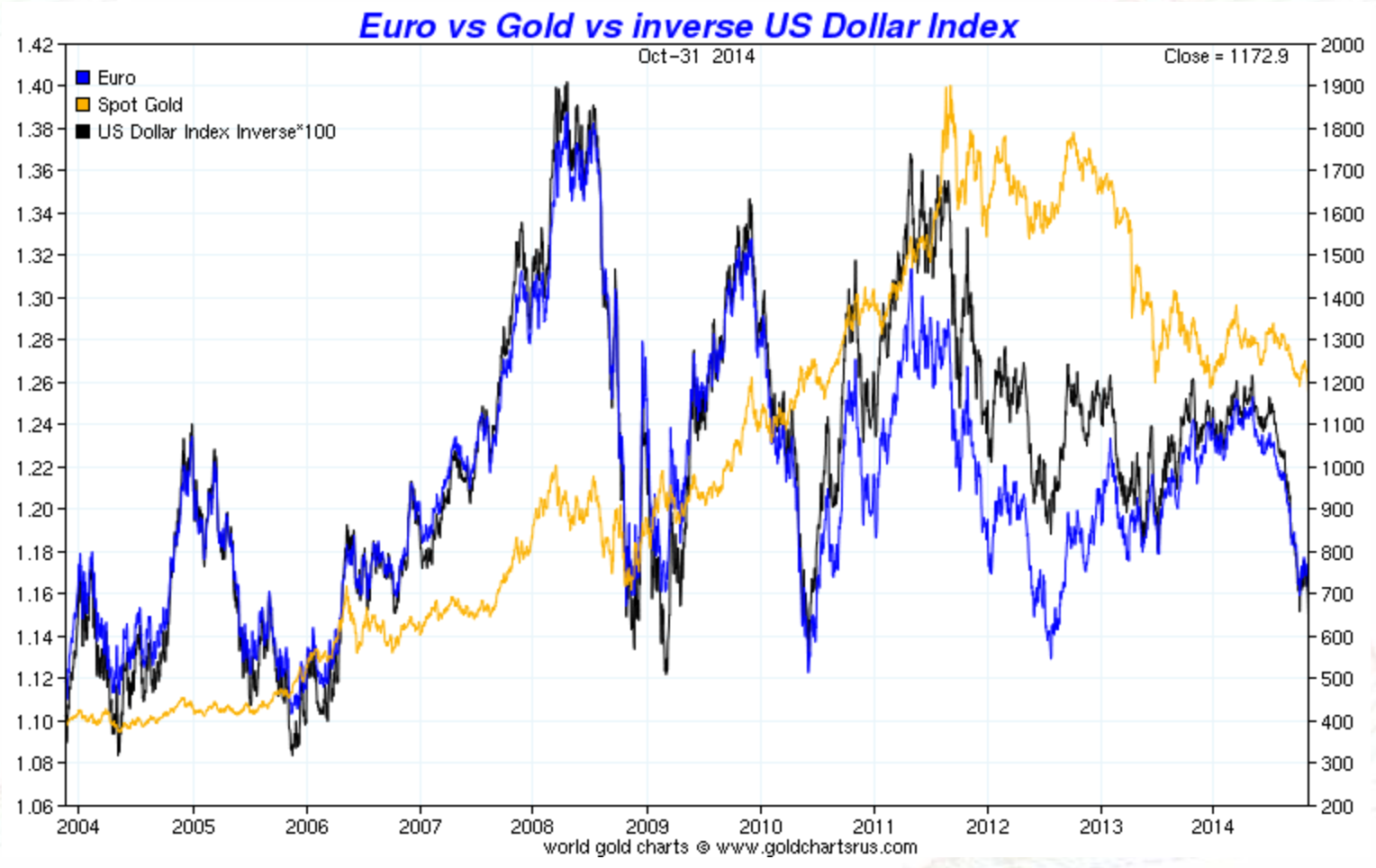

This is confirmed by observing, in the chart below, the almost perfect correlation between the US dollar index and the euro/US dollar exchange since 2002.

Chart #4: Euro vs Gold vs Inverse US Dollar Index

A better image would be to look at the US Dollar Trade Weighted Broad Index. It includes major US trade partners and, especially, the BRIC countries. The Broad Currency Index includes the Euro Area, Canada, Japan, Mexico, China, the United Kingdom, Taiwan, Korea, Singapore, Hong Kong, Malaysia, Brazil, Switzerland, Thailand, Philippines, Australia, Indonesia, India, Israel, Saudi Arabia, Russia, Sweden, Argentina, Venezuela, Chile and Colombia.

Chart #5: Trade Weighted US Dollar Broad Index

I think the recent US dollar bull market is a short move and that dollar bulls will have a very rude awakening. There is also euphoria about the U.S. stock market that has been pumped up by the Fed through QEs. It looks as we are seeing the formation of a top in the stock market and it will coincide with a collapse of the dollar and a quantum leap in gold. I hear statements in the financial industry that I used to hear just before the collapse of the 2000 stock market bubble. Then it was a “new economy” and the end of cycles and today it is that the Fed will not let the stock market fall.

There is also a belief that gold and the euro/dollar exchange have to move together. This is wrong. In recent years, gold has increased with respect to all fiat currencies or more correctly, I should say has maintained its value while fiat currencies have been devalued competing to arrive first to their target, zero. It is possible to have the US dollar appreciate against the euro while at the same time fall against gold. The U.S. has also made it clear it does not want to see a stronger dollar and will intervene in the foreign exchange markets to ensure that. However, at the same time, the ECB has made it clear it wants a weaker euro. As you can see, currency wars are alive and I expect them to grow, irrespective of the G20 agreement not to follow such policies.The currency wars will end badly with the collapse of the US dollar-based international monetary system and gold taking front stage in any new system.

Gold will not move this time as it did between 2000 and 2009, slowly and progressively, but with a quantum leap. When all the petrodollars have no oil to buy, they will come home to roost, and all at once.

Short term, however, the US dollar still has the bullish momentum and gold the negative one, but don’t be blinded by the short term. Gold is closer to a bottom and the dollar is closer to a top.

20:16

20:16

Unknown

Unknown