This is featured post 2 title

Replace these every slider sentences with your featured post descriptions.Go to Blogger edit html and find these sentences.Now replace these with your own descriptions.This theme is Bloggerized by Lasantha - Premiumbloggertemplates.com.

This is featured post 3 title

Replace these every slider sentences with your featured post descriptions.Go to Blogger edit html and find these sentences.Now replace these with your own descriptions.This theme is Bloggerized by Lasantha - Premiumbloggertemplates.com.

Sunday, 23 November 2014

22:03

22:03

Unknown

Unknown

PELAHIIVKA, Ukraine (AP) — Workers have finished recovering wreckage from the Malaysia Airlines Flight 17 disaster, more than four months after the passenger jet was shot down over rebel-held eastern Ukraine.

Under the supervision of Dutch investigators and European security officials, the recovered fragments were loaded onto a train in the village of Pelahiivka and shipped to the Ukrainian government-held city of Kharkiv on Sunday.

The investigation into what happened to MH17 is being conducted there and in the Netherlands. Ukraine and Western governments accuse Russia-backed separatist fighters of firing rockets that felled the plane, killing all 298 people aboard, while Russian state-run TV has blamed Ukraine's air force.

The recovery operation, which took a week, had been delayed because of continued fighting between government troops and separatist fighters despite a cease-fire agreement reached in September.

A volley of rockets hit a residential district Saturday evening in western Donetsk, the main rebel-held city, injuring at least one resident.

"A Grad rocket came through the roof, hit the ceiling and then ... finally embedded itself in the floor," Vladimir Goryanskiy said Sunday. "It was yesterday. My wife was sitting close to it and only a miracle saved her. Her arm was broken and she suffered a cut tendon and some other cuts."

Ukrainian forces have firing positions to the north and west of this neighborhood in the Kuibyshivskyi district. Outgoing fire also was heard Saturday evening. Shelling has hit the working-class neighborhood before, and several homes are now empty because residents have moved to safer areas.

22:03

22:03

Unknown

Unknown

Next Week's OPEC Meeting, Eurozone Data Gives Gold Much To Consider

By Debbie Carlson

The gold market has a full plate next week: there’s a major meeting of the Organization of Petroleum Exporting Countries, inflation data out of the eurozone, and a major holiday in the U.S. to keep volatility high.

|

Gold could see some mercurial trade to start off the week as Comex December gold options expire on Monday, adding another dimension to the week’s action. The market may also see some last-minute positioning ahead of the Nov. 30 Swiss gold referendum.

December gold futures rose Friday, settling at $1,197.70 an ounce on the Comex division of the New York Mercantile Exchange, up 1.02% on the week. December silver rose Friday, settling at $16.395 an ounce, up 0.5% on the week.

In the Kitco News Gold Survey, out of 36 participants, 23 responded this week. Of those, 14 see prices up, while six see prices down and three see prices sideways or unchanged. Market participants include bullion dealers, investment banks, futures traders and technical chart analysts.

Gold saw a volatile trading this week, ultimately closing the week higher and notching a third straight week of gains. A surprise interest rate cut Friday by China pumped up the yellow metal, traders said. The People’s Bank of China cut the one-year benchmark lending rate by 40 basis points to 5.6% and the one-year deposit rate by 25 basis points to 2.75%.

“At face value, policy easing in China should be gold-supportive, particularly if it helps to hold up economic growth,” said Joni Teves, analyst at UBS. “But UBS China economists do not think that today's rate cut moves the needle for 2015 GDP growth expectations. So, while today's rate cut may be gold-friendly at the margin, ultimately the effect should be more muted than what the initial reaction might suggest.”

Gold managed a rise above $1,200 even as the dollar gained on the Chinese news and as the European Central Bank started to buy asset-back securities as part of its stimulus program.

George Gero, vice president with RBC Capital Markets Global Futures, said gold attracted some buying when it rebounded over $1,200.

“There were too many negatives priced in the past two weeks,” he said about why gold bounced on Friday.

Gold will start out the week watching Monday’s options expiration for the December contract, and it could lead to some volatility, Gero said. Option strike prices that are “in the money” or are the same value as the current futures price will become futures after the expiration.

“There were many $1,125 and $1,100 strike puts and there are many $1,200 and $1,225 call options as well, so some nail-biting may ensue,” he said.

Early next week also features traders moving positions out of the December futures and into deferred months as the calendar nears the month of December, he said. Ahead of first notice day traders need to eventually exit futures positions of the spot month according to exchange rules.

Later in the week, analysts said they’ll watch to see what eurozone inflation data shows. Inflation has remained tame, which doesn’t support gold, analysts said, and eurozone inflation has been particularly soft.

In the U.S., third-quarter gross domestic product data is set for release, and analysts at Nomura expect it will come in at 3.5%, which is unchanged with the preliminary reading.

Robin Bhar, head of metals research at Société Générale, said those two data sets will likely underscore the current view of a stronger U.S. economy versus a weakening eurozone.

“I think the theme will still be U.S. growth, and the Fed (Federal Reserve) is ooh-ing an ahh-ing about being data dependent, and it (stronger data) could cause the Fed to have to raise rates down the road, which would weigh on gold,” he said.

Thursday is the Thanksgiving holiday in the U.S. and markets are closed. Trading volume could slow as the week nears Thursday, and Friday is often taken as a day off to extend the holiday. Markets are open as usual on Friday.

Bhar said in addition to Thanksgiving, there are a couple of other holidays next week, too. He said it’s possible that gold prices could try to consolidate at higher values amid the lower volume; however, he said the light trading volume could mean a greater chance for whippy action.

“It could allow Asian (traders) to bully the market down. We’ve seen some heavy selling in the Asian time zone and we know the liquidity … is thin,” he said.

Gero and Bhar both said next week’s OPEC meeting on Thursday will be a key event, too. Crude oil prices have fallen sharply as China and the eurozone use less oil because of struggling economies there. On top of that, U.S. shale production is at 30-year highs, so the globe is awash in oil. So far Saudi Arabia has been cool to the idea of cutting production to support prices, so people will be watching this meeting to see if the cartel decides to cut output.

“If there are production cuts, it could lift oil prices and support gold as it would be mildly inflationary, but if they don’t cut to shore up production that could be another negative for gold,” Bhar said.

Traders could position themselves ahead of the Nov. 30 Swiss gold referendum vote, said Ira Epstein, of the Ira Epstein division of the Linn Group. The ballot measure calls for the Swiss National Bank to not sell any more gold, have all Swiss-owned gold housed in-country and require that 20% of the SNB’s assets be in gold bullion.

Polls taken ahead of the vote show the “no” side with the edge and the gold market moved to its low for the week when the most recent poll came out Wednesday.

“The swings (in the market ahead of the vote) are and will continue to be fairly wild unless the poll results widen in favor of the ‘no’ vote,” Epstein said, who added he believes the measure will fail.

22:02

22:02

Unknown

Unknown

Gold Prices Starts Week Hovering Around Initial Support At $1,200

Gold prices are starting the week holding on to recent gains, hovering around initial support at $1,200 an ounce.

Electronic trading of Comex December gold futures opened the Sunday North American evening/Monday Asian session at $1,199.90 an ounce, relatively up from Friday's pit close of $1,197.70 an ounce.

About 40 minutes after the open, gold futures reached an early session high of $1,203.80 an ounce. Since then prices have been trading in a modestly tight range; as of 9:36 p.m. EST December gold was at $1,200.40 an ounce.

Electronic trading of Comex December silver futures opened the Sunday evening/Monday morning session at $16.365 an ounce, slightly down from Friday's pit close of $16.395 an ounce. Similar to gold, the silver market has traded in a small range; as of 9:36 p.m. EST, December silver was at $16.405 an ounce.

Victor Thianpiriya, commodity strategist at ANZ, said that although gold is holding on to some of its strength the market remains positioned for lower prices in the near-term.

On a technical basis he said $1,200 will continue to act as strong initial support. The next level on the upside he is watching is the mid-October high of $1,255 an ounce.

However, Thianpiriya said that he expects the U.S. dollar will remain strong and in turn hurt the gold market.

“All the growth right now is in the U.S. and that is positive for the U.S. Dollar, negative for gold,” he said. “I don’t think the market has fully priced in the Federal Reserve’s next move.”

Chris Weston, commodity analyst at IG Markets, said that although he is generally bearish on gold, momentum appears to be supporting prices in the near-term.

However, Weston added that prices could move higher next week as traders exit their short positions ahead of Switzerland’s Gold Referendum. Polls shows that there isn’t enough support for the vote to pass, but Weston added that the risks still aren’t worth it, on the outside chance that it passes.

“Gold prices could easily rally $50 an ounce in one session if the vote passes, which I think is unlikely,” he said.

Looking at technicals, Weston said that the key level in gold will be $1,208 an ounce. He added prices need to break above that to test the next major resistance level of $1,276 an ounce.

Analysts from HSBC said in a note published Friday that gold needs a “convincing close” above $1,200 an ounce to encourage further gains in the marketplace.

20:39

20:39

Unknown

Unknown

Gold’s Volatility & Other Things to Watch

Gold’s reversal from $1130 to $1200 combined with sharp rebounds in the gold miners has given precious metals bulls some hope that the bottom may be in. A few weeks ago we noted that the sector was extremely oversold and a snapback rally could begin. Gold has been the tell for the bear market and a real bull market throughout the precious metals complex may not begin until Gold’s bear has ended. In this editorial we dig deeper into some things to watch as they pertain to Gold.

First we will focus on Gold’s volatility. The chart below shows Gold and two volatility indicators: the CBOE volatility index and average true range. Peaks in daily volatility have coincided with important peaks and troughs in the Gold price. Volatility declined from summer 2013 through summer 2014 before perking up as Gold declined from $1255 to $1130. Yet both volatility indicators are not close to extremes. Volatility does not necessarily need to reach an extreme to signal a bottom. However, the two biggest volatility spikes were at the 2008 bottom and 2011 peak. A sharp decline in Gold below $1100 towards major support combined with a spike in volatility could signal a major turning point.

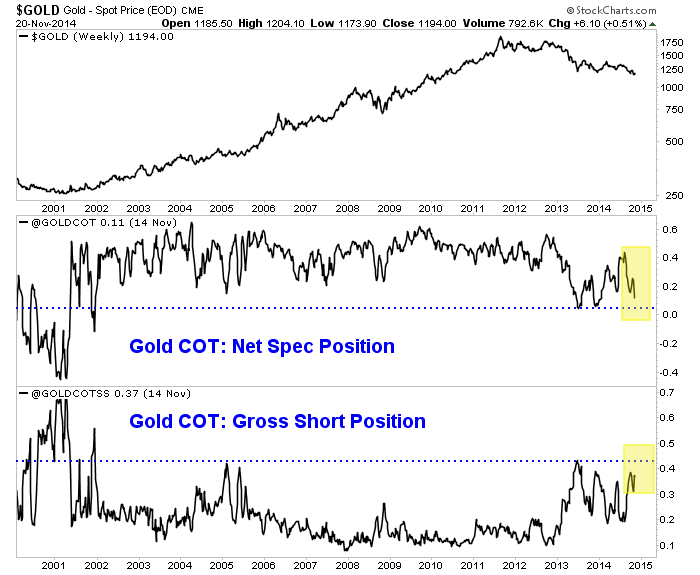

I’m also focusing on the COT as its an excellent sentiment indicator. By some metrics (objective and anecdotal) Gold’s bear market has reached extreme territory. However, the COT is presently not at an extreme. We plot (as a percentage of open interest) the net speculative position and the gross short position. If these readings can exceed the 2013 extremes then they would be at 13-year extremes. A spike in the gross short position, while negative in the short-term provides future fuel (short covering) for a very strong rebound off the bottom.

Meanwhile, let’s not forget Gold’s relative strength. We shared the importance in a recent missive. We noted Gold’s relative strength tends to perk up before Gold itself bottoms. The chart below plots Gold against a foreign currency basket (the inverse of the US$ index) and Gold against the S&P 500. Gold is holding up well against foreign currencies but is coming to an inflection point. I don’t think its going to breakout yet but I could be wrong. Meanwhile, Gold continues to be very weak against the stock market.

Gold has been the tell for the bear market and my work leads me to believe the bottom is ahead and not behind us. Last week we noted the likelihood of a test of major support near $1000/oz rather than a bottom at an arbitrary level. In addition, Gold has yet to have a volatility spike on par with the spikes at the 2008 bottom and 2011 top. Moreover, current positioning in the futures market remains below the extremes seen in 2013. Finally, Gold has more work to do on the relative strength front before it can sustain a recovery.

All this being said, it is important to keep an open mind to various possibilities. Silver and the mining stocks are totally bombed out and we should pay close attention if they retest their lows. The weeks and months ahead figure to be enticing and exciting for precious metals traders and investors. Expect quite a bit of day to day volatility as we see forced liquidation and occasional short covering. Be patient but be disciplined. As winter beckons we could be looking at a lifetime buying opportunity. I am working hard to prepare subscribers.

19:52

19:52

Unknown

Unknown

Gold: Now What?

Mary Anne & Pamela AdenThe Aden Sisters

Posted Nov 22, 2014

Gold has been volatile in recent weeks. It broke down, then it bounced back up. So where does it currently stand?

Gold’s timing will help us in identifying the lows and the steps upward towards a new bull market.

Chart 1 shows our favorite gold timing tool. As our older readers know, gold has had recurring cycles going back for years.

(Click on image to enlarge)

Currently, a D decline has been underway since last March when gold’s 2014 rise petered out. D declines tend to be the worst decline in gold’s cycle. And during bear markets, D declines usually take gold to new lows for the bear market.This is exactly what happened this month. Most impressive, the leading indicator has yet to fall into the extreme low areas that normally coincide with D lows... This means gold could still go lower before this decline is over.

On the downside, gold will remain weak below $1200, and especially below its $1180 low. And the longer this is the case, the more likely we’ll see lower lows soon.

A clear decline below $1150 means $1100 would be a shot away. This would likely take the indicator down to test the extreme D lows.

GOLD SHARES: Fell the most

Gold shares, however, took the cake. They plunged much more than gold and silver. And the gold share indexes fell to their 2008 lows. That is, they fell to the lows of the depths of the financial crisis washout.

The HUI Gold Bugs index is now starting to consolidate near these lows above 150, and as long as that’s the case, we just may see the start of constructive base-building.

Gold mining shares are weaker than gold, the most they’ve ever been since the 1960s. This weakness is not over yet, but the 5 week moving average works well in identifying the start of a turn.

So keep an eye on 170 for HUI. If it can stay above this level, gold shares will be looking better and they could then be leading gold.

Subscribe to:

Comments

(

Atom

)