What’s In Store For Gold in 2015?

The following article is from Gold Stock Bull contributor,

Ben Kramer-Miller. While I agree with his overall assessment and

reasoning, I am a bit more bullish in the short term and think precious

metals have likely already found a bottom. Of course, short-term pricing

is driven by paper derivative contracts and the emotions of investors

that either panic or buy the dip when the sharp price movements occur,

so anything is possible in the short term. In the medium to long-term,

we both agree that prices for both gold and silver are moving

substantially higher and that 2015 will prove to be an excellent year to

accumulate metals and undervalued miners. Cheers – Jason Hamlin

Overview

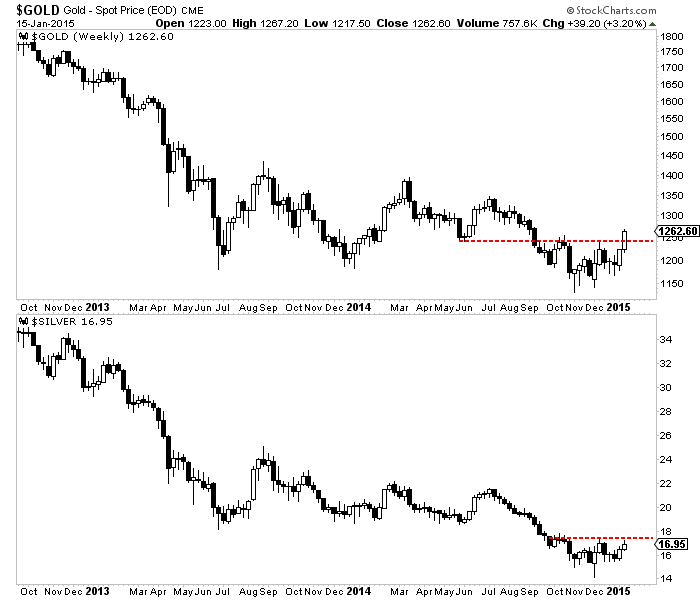

After a lousy 2013 gold was essentially flat in 2014. The London AM

fix on December 31st came in at $1,199.25 in 2014 vs. $1,201.50 for

2013.

The year started out strong and many gold bulls called the end of the

downtrend. However a strengthening US Dollar, signs of economic growth

in the US, and concerns over the Fed’s tapering program put an end to

the bull market pretty early in the year when gold peaked in March at

~$1,370/oz.

These signs, among others (which I will discuss in a moment),

prompted me to

call for more downside in the gold market in September when the price

was hovering around $1,300/oz. Shortly thereafter the gold price fell

below its critical support level of ~$1,180/oz. and traded down to

~$1,135/oz. before rebounding back to today’s range, which is roughly

$1,180 – $1,220/oz.

So where do we go from here?

As a gold bull I want to believe that gold is going to start moving

higher from here, but unfortunately I think the odds remain stacked

against this, and that we will see further downside before the bull

market resumes. I will first go through the reasons why I think this is

the case and I will then discuss how to play this.

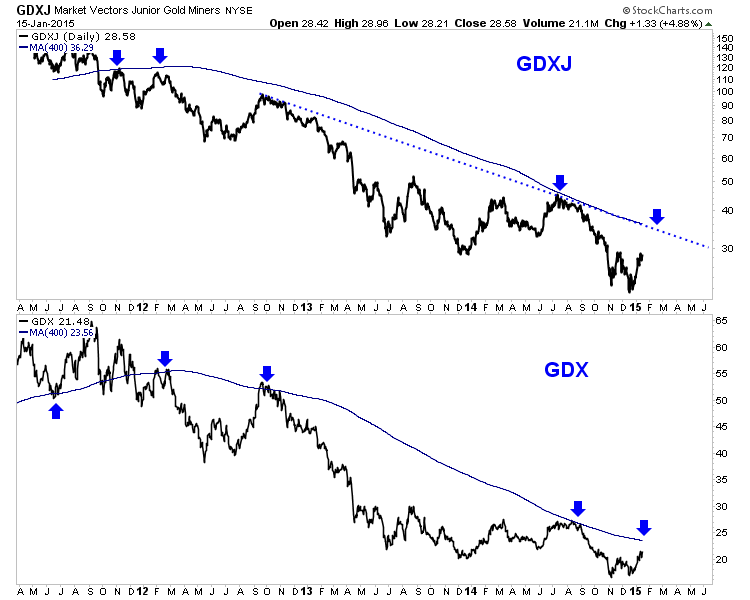

Why Gold Probably Has More Downside

Again I discussed some of the reasons I think gold has more downside

in the near term in September. It is worth repeating/updating a couple

of these reasons, and I also want to bring a couple others into the mix.

1-Gold Didn’t Test Its 2009 Breakout Point

Gold has experienced two significant corrections since the bull

market began at the turn of the century. The first was in 2008 and the

second began in 2011. One thing that differs between the two besides

their durations is that when the market bottomed in 2008 it hit a major

support level of ~$700/oz. This level is technically significant because

it had previously been resistance from April, 2006 through August,

2007. But we have not seen gold test its previous breakout point in this

downtrend. The last breakout point was the resistance level of

~$1,000/oz., which is where the market peaked in 2008. The breakout led

to the subsequent rally all the way to ~$1,900/oz. in 2011. Now if the

pattern were going to repeat the gold market should test the $1,000/oz.

level, but as you can see on the following 10-year chart of the SPDR

Gold Trust (NYSEARCA:

GLD) we haven’t seen this.

Technical analysts would argue that a test or even a quick breach of

the $1,000/oz. level (or ~$95/share for the GLD) would wipe out the

speculative money that entered the market after the gold price broke to

its new all-time high, and that this would be needed in order to set the

stage for a fundamentally driven leg higher.

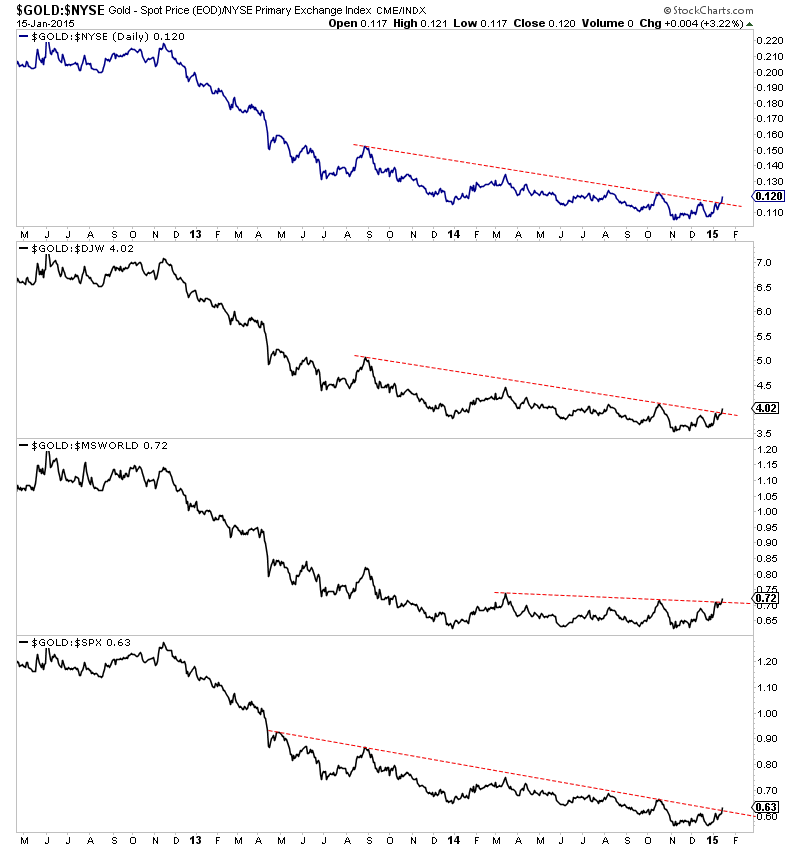

2-Stocks and Bonds Remain In Favor

Broadly speaking I am not bullish of stocks, and I am downright

bearish of bonds. But there is no denying that these assets have been

performing well over the short and intermediate term. While the

mainstream financial press would have you believe that these assets

trade opposite to one another they are historically correlated, and

pertinent to this discussion they are negatively correlated to gold.

Stocks and bonds are both financial assets, meaning that they are

claims against another entity that owes something to the stock or bond

holder (e.g. dividends or interest payments). Despite the fact that

stocks and bonds are richly valued on an historic basis investors don’t

seem to care. Easy credit from the Fed makes these low returns appealing

on a relative basis, and this puts pressure on assets whose value is

intrinsic such as gold and other commodities.

At least in the near term bonds will remain expensive because central

banks will see to it that interest rates remain low, and stocks respond

to this as low bond yields make stock dividend and earnings yields more

attractive by comparison.

With financial assets in favor real assets are, by extension, out of

favor. Commodities in general–not just gold and precious metals–have

been weak with very few exceptions.

Now financial assets are, broadly speaking, overvalued while

commodities are generally undervalued, and this includes gold. But the

market is not at a point where these disparities really matter. So long

as money remains cheap bond prices can rise and anything that has a

yield can rise with them. At some point this situation will reverse

itself, but for now it suffices to say that it makes sense to yield to

Newton’s first law of motion, and acknowledge that financial assets will

keep rising while tangible assets will keep falling until something

happens to reverse this trend.

3-Federal Reserve Tapering and Rising Interest Rates Are Perceived To Be Bearish for Gold

This follows from the misconception that I just discussed. Many

investors are concerned that the Fed has stopped pumping money into the

market via its QE program, and that this is bearish for gold. The

intuition is that there will be less money in the financial system to

bid up gold prices.

The fact is that if the Fed raises rates there may very well be less

money in the system. And this perception has the potential to drive some

naive investors out of the gold market and some speculators to short

the market.

We’ve seen, however, that this is misguided and we will shortly see just how misguided this actually is.

4-The Dollar Index Has Been Strengthening

One of the big surprises this year has been the strength in the

Dollar Index, as you can see on the following chart. courtesy of

Barchart.com.

This strength has led investors to believe that the Dollar itself is

strong, and it leads investors to avoid investments in gold and in other

commodities.

Now gold bulls know that Dollar Index strength is not the same thing

as Dollar strength. The former simply means that the Dollar is

increasing in value relative to a basket of currencies that includes the

Euro, the Yen, the Pound, and others. But this doesn’t mean the Dollar

itself is strong. For instance, the Dollar Index has gained about 15%

since its 2008 low, but the Dollar has lost about a fifth of its value

relative to gold.

Nevertheless in the short run this perception can trump reality, and a rising Dollar Index can be short-term bearish for gold.

The Bullish Perspective: Rising Rates Will Send Gold Soaring

A novice view of the phenomena just discussed paints a very bearish picture for the gold market.

But a deeper analysis of these phenomena–particularly the second and the third–paints an extremely bullish picture.

We saw earlier that QE and ZIRP has created demand for bonds and

stocks because even their paltry interest rates are attractive in the

context of very low interest rates available on cash/equivalents while

there is more money in the financial system to bid these assets higher.

This takes away money from the gold market which doesn’t generate any

income.

While this line of reasoning makes sense unto itself I think a lot of

investors are confused in the sense that quantitative easing and ZIRP

(i.e. zero interest rate policy) have not pushed gold higher. Shouldn’t a

rising money supply have precisely this effect?

In spite of this intuition the above line of reasoning holds and

historically the gold price has performed best when the Fed’s benchmark

rate has been trending upward. I discussed this at length in

another article and I have imported the following chart for the reader’s convenience.

Investors who don’t understand the logic behind the obvious

correlation here should think of it as follows. Low interest rates and a

rising money supply are bullish for gold in the same way that pushing a

beach ball under water is “bullish” for the beach ball in the sense

that when the pressure is lifted the beach ball will fly higher than it

would have otherwise. To put it another way low interest rates are

bullish for gold in that they give it potential energy, but kinetic

energy will send it higher, and it will take rising rates to convert

this kinetic energy into potential energy.

With that being said gold I think it is important to point out that

gold is being infused with an unprecedented amount of “potential energy”

in the sense that never in this history of the Federal Reserve has the

monetary base risen so rapidly. We can see in the following chart that

the monetary base has risen 5-fold (17% per year) in the past 10 years.

Gold doesn’t necessarily trade with the monetary base but we can use

it to get a good idea of gold’s relative valuation by looking at the

value of America’s gold relative to it.

We can see that using this metric not only is gold undervalued, but

it is more undervalued than it has been since 1918, which is as far back

as the Fed’s monetary base data goes. We can also see that in spite of

the fact that the gold market traded to a nominal record high in 2011

that it has–from at least one perspective–been in a bear market for the

past 35 years.

What Will Signal The Turnaround?

So gold is incredibly undervalued and is perhaps in a multi-decade

long bear market. Why should the downtrend end anytime soon, and what

should we look for as a signal that the bear market is actually coming

to an end?

We’ve already seen the answer to this above–rising rates. The Fed has

signaled that it will raise its benchmark interest rate starting this

year for the first time since 2008, and we’ve seen that this will make

bonds and stocks less attractive on a relative basis, and some of this

“excess” money will find its way into gold.

So one scenario is that the Fed increases rates, the gold market has a

knee-jerk reaction to a new low as pundits ramble on about how negative

this is for gold, and then the market reverses sharply from its new low

and begins a new uptrend.

There is a problem with this scenario, however. Every time the Fed

has removed stimulus from the market the stock market has fallen and it

begins a new “panic,” which in turn gives the Fed an excuse to continue

with more stimulus.

I think we can still see gold rise in this scenario because interest

rates can only go so low and bond/stock yields can only go so low as

well. Already bond and stock yields are at historic lows, and while the

can go lower eventually their overvaluations will get the best of them

and we can see money enter the gold market. One might argue that we may

already be on the verge of this given some signs such as the downturn in

junk bonds (see the following chart of the iShares High Yield Debt ETF

(NYSEARCA:

HYG) and the uptrend we’ve seen in volatility. Both charts are courtesy of Stockcharts.

But in this case what sort of signal should we look for? that the gold market has turned?

In this scenario I think investors should look at Gold Forward

Offered Rates (GOFO). This is the rate at which bullion banks lend gold.

The lower the rate the more desirable it is for banks to hold gold.

But what specifically should we look for, and how does this tie in with the current scenario?

A lot of investors suggested recently that the fact that the GOFO

rate went negative towards the end of 2014 that the gold market had

likely bottomed. I think this is misleading considering the current low

interest rate environment that we are experiencing, and this point is

supported by the fact that GOFO went negative in 2013 and this didn’t

signal a bottom in the gold market.

What we need to see, therefore, is for bullion banks to value gold

substantially more than they value interest-bearing paper assets, and so

I think the signal to look for will be relative GOFO rates. This is a

data point that is measured via LIBOR minus GOFO. If this rises

substantially it means that investment banks would much rather hold gold

than interest bearing assets as short term interest bearing assets are

correlated at least in part to LIBOR rates.

When we back-test this thesis we can see that spikes in 1-month LIBOR

minus GOFO have been predictive of new uptrends in the gold price.

Each major spike has corresponded with a buy signal in the gold

market. Now if we zoom in on the past couple of years we can see some

mini-spikes, but nothing resembling the 1999, 2001, and 2008 spikes

pictured above.

19:47

19:47

Unknown

Unknown