Jordan Roy-Byrne: I do not think we have seen the bottom, but I think we are very close. It should happen within the next couple of months.

TGR: Why do you think we're so close?

JRB: Typically, markets don't bottom at random numbers. Gold has really strong support at $1,080/oz, which is the 50% retracement of the entire bull market, and at $1,000/oz, which is the key psychological level and also was a key support level in 2008–2010, so gold is more likely to test those levels than bottom at $1,137/oz.

Two more reasons to believe we haven't hit bottom are volatility and the Commitment of Traders' (COT) report. The two biggest volatility spikes in the last six years were at the 2008 bottom and then at the 2011 top. In the last month or so, volatility has picked up after being absent for most of 2014. Gold's trend is down, so increasing volatility suggests a sharp selloff that could take gold below $1,100/oz. A spike in volatility combined with major support at $1,000/oz is one recipe for a major reversal.

"Balmoral Resources Corp. has a great gold deposit, Martiniere, in a great jurisdiction, Quebec."

The COT report, which tracks futures traders, suggests that we have not hit an extreme, but again it's very close. A decline below $1,100/oz or $1,080/oz would likely result in many traders panicking out of the market and at the same time putting on more short positions. Given the current construction of the COT, a decline below $1,100/oz in gold would result in the net speculative position and gross short positions reaching 13-year extremes.

TGR: An alternative explanation for the fall in the gold price is aggressive shorting by institutions such as Goldman Sachs, perhaps aided and abetted by central banks. What do you think of that?

JRB: I don't think anything of it. Yes, short positions have increased, but this is how futures markets work. It's just sour grapes.

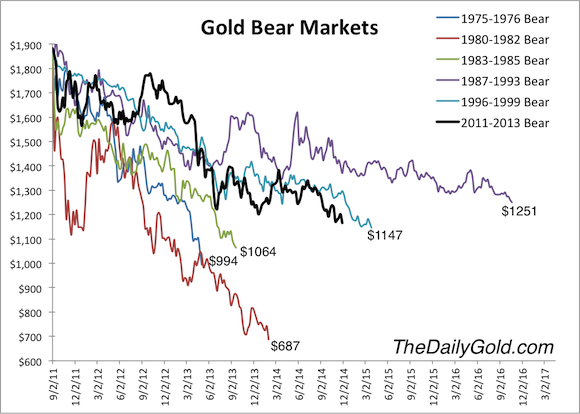

TGR: Talk about your bear analog for gold and what it tells us.

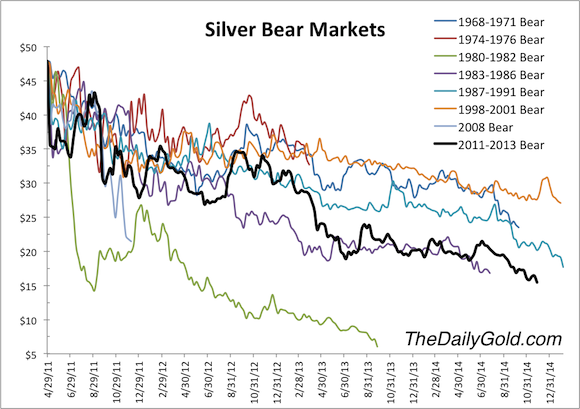

JRB: I'll talk about that but also about my analogs for silver and mining stocks. These analogs examine the historic bear markets and plot them on graphs in order to compare them. We must remember that bear markets are a function of price and time. And those with the sharpest declines last the shortest amount of time. The gold and silver crashes in the 1980s lasted less than two years. They were spectacular declines with most of the damage done quickly. But bear markets that last for years are not particularly severe in terms of price.

TGR: What do your analogs tell us about silver and mining stock bear markets?

JRB: Most bear markets in mining stocks average about a 65% decline. What we've seen in the current bear market is well in line with history. Silver bear market declines are typically 50–70%.

TGR: So the ongoing bear markets in gold, silver and mining stocks are historically typical?

JRB: The current bear markets have lasted a little over 3 years for gold and over 3.5 years for silver and mining stocks. They've been fairly severe in terms of time and price but not extreme. Keep in mind that gold went from $250/oz to almost $2,000/oz and silver from less than $4/oz to $50/oz. Those were spectacular moves.

That said, the entire bear market is more severe than what one would have expected. The reason is that we had a very strong advance in 2001–2011, with only a mini-bear market lasting six months in 2008.

TGR: What about the possibility that the current bear markets will break through historic precedents?

JRB: It's always possible. It remains my belief, however, that gold could fall another $200/oz to tick below $1,000/oz and fool people that we are still in the thick of the bear market, when we have actually come to the end. Now, if we don't have a bottom by the middle of next year, and gold is lagging under $1,000/oz, your question will be more pressing.

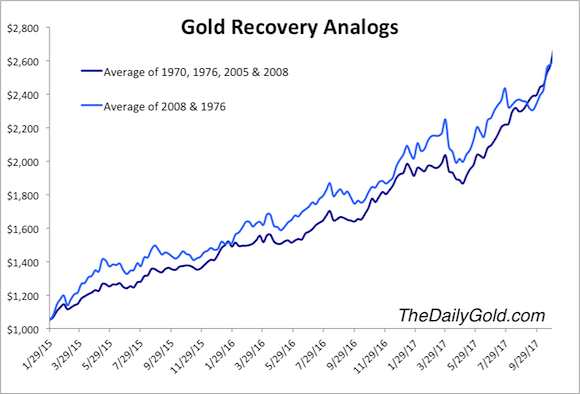

TGR: You also have a gold recovery analog. What does this suggest with regard to how high gold will rise with the next bull market?

JRB: This analog examines the strongest historic cyclical moves in gold and applies them forward. My chart begins with a $1,050/oz bottom at the end of January 2015. I've merged the recoveries of 1970, 1976, 2005 and 2008 into one average and the two strongest recoveries, 1976 and 2008, into another.

These data suggest that gold should hit $1,500/oz within 12 months from the bottom. If gold does bottom in the next four months, the analog presents a very strong case that gold will retest $1,900/oz by the end of 2016.

TGR: The analog also suggests a high above $2,600/oz by September 2017. That would be an all-time, inflation-adjusted high, correct?

JRB: Correct. If gold tops $1,900/oz again, one would expect greater moves and increased volatility after that. The recovery analogs suggest that gold could start to go parabolic around $3,000/oz. How high would it go? I think $5,000–10,000/oz by maybe 2019 or 2020.

TGR: Hundreds of precious metals equities have reached 52-week lows since October. Given your forecast about the near-term bottom, is today a good day for investors to buy these stocks?

JRB: I would say no because should gold fall below $1,100/oz, there will be a final cleanout, and only then will that space be fully derisked. Over the last 18 months or so, I have been fooled several times in believing that gold stocks had been so oversold they couldn't go any lower. While they rebounded strongly for several months, they ultimately went lower.

Gold has always been the real driver of this bear market in precious metals equities, so I don't want to buy the equities until we see the final move down in gold. The bear market is mostly over. The risk/reward ratio is generally excellent now, but I think we could have a little bit more pain. And, of course, investors must choose companies carefully because these precious metals equities are all over the map.

TGR: After we've bottomed out, and market interest returns, what should investors look for in gold producers?

JRB: Number one is production growth potential and the financial position to ensure that growth. Look at companies with mines producing close to or above 100,000 oz (100 Koz) per year and mines that are early in their lives. Also, consider companies that are barely profitable right now. At $1,500/oz gold, barely profitable becomes strongly profitable. That change in margin is huge for the stock price. These are the factors that could drive the best share performance. Investors should also look for companies in the best jurisdictions because they're the best takeover targets.

TGR: What should investors be looking for in exploration and development companies?

JRB: Experienced management teams that have built mines before or sold them before or have track records of success in discovery and exploration. Their companies should have several-million-ounce deposits in good jurisdictions, deposits than can support mines at 100 Koz per year or more. Companies with smaller deposits should be avoided because such deposits will require these companies to build the mines themselves, which is really tough.

TGR: Which jurisdictions are best?

JRB: Canada, Nevada, Mexico and West Africa. This is where the majors are. And majors with operations in Nevada or Mexico, for example, will want to make acquisitions there. They don't want to build big new camps somewhere else.

TGR: How low should the all-in gold production costs of these development companies be?

JRB: Companies with deposits that require a gold price of $1,500/oz to be profitable are just too high risk. Should gold fall to $1,000/oz, these companies can fall to $0.01 a share or trade at their cash value.

Their deposits should make good money at $1,200–1,300/oz and have internal rates of return (IRRs) of at least 20% after tax. Deposits like these have the best risk/reward ratio and good leverage. And should gold rise to $1,400–1,500/oz in the next year, these companies can make really, really good money. Best of all are companies with advanced projects that have multimillion-ounce deposits that are low cost and fully financed.

TGR: Can you give an example of one such company?

JRB: Obviously, there are very few such companies out there, but one example is

Guyana Goldfields Inc. (GUY:TSX) and its Aurora gold project. Aurora will produce 194 Koz per year for 17 years. Its initial capital expenditure is only $249 million ($249M). It has an after-tax IRR of 31% and an after-tax net present value of $735M. It has solid growth potential as well. Aurora's Proven and Probable resource is 3.48 million ounce (3.48 Moz) gold, while its Measured and Indicated resource is 6.54 Moz, with 1.82 Moz Inferred.

Construction is underway, with production scheduled for mid-2015. Production cash cost is $527/oz gold, so it can make good money at $1,000/oz gold. It is a surefire takeover candidate at some point. Companies like this are the stocks you want to watch very closely because if we see that final decline before the bottom, you can buy them at better prices then if you bought them right now or at $1,300/oz gold.

TGR: What other type of explorer/developer are you keen on?

JRB: Companies with multiple deposits. I'll name two. The first is

Balmoral Resources Ltd. (BAR:TSX; BAMLF:OTCQX). Its stock has been a very strong performer recently. It has a great gold deposit, Martiniere, in a great jurisdiction, Quebec. Balmoral's value driver is its nickel-PGM discovery, Grasset, which has had some great results, including 1.85% nickel, 0.21% copper, 0.4 g/t platinum and 0.97 g/t palladium over 57.9 meters, announced Nov. 26. So Balmoral has two deposits, and it could spinoff Grasset into a new company if it wants or sell it and use that cash to really drill out Martiniere.

The company did a $10M financing this month. It is cashed up and has great management. Darin Wagner, the CEO, and his team are winners, and they know where to drill as evidenced by two tremendous discoveries.

TGR: What's the second?

TGR: Some shareholders in Cayden were disappointed because they thought the sale price of $205M was less than it was worth.

JRB: Over time, with a higher gold price and more drilling it would have been worth more. Today, it seems like a really good deal.

TGR: Besides taking out Cayden, Agnico has also, with Yamana Gold Inc. (YRI:TSX; AUY:NYSE; YAU:LSE), bought Osisko Gold. Has Agnico played a smart takeover game?

JRB: Agnico is very aggressive. Its stock was doing really well when things were booming. I think Agnico has done a good job making small investments in juniors and is well positioned for the future, assuming a big recovery. I was a little surprised by the Cayden buyout, but Cayden has really good grades in a top jurisdiction. I think Cayden is something of a one-off.

TGR: Which companies will lead the next wave of mergers and acquisitions (M&As)?

JRB: First off, I don't see a lot of M&As until we get a confirmed bottom in gold, when it rises above $1,300/oz, perhaps. That's what will persuade the majors that the bottom is in. At that time, their financials will be picking up, and that's when they can pick off some of the best assets. Maybe late 2015. Right now, most companies are trying to make sure they survive if gold goes below $1,100/oz.

TGR: What about the prospect of proactive takeovers by companies confident enough in gold's future to save $100M or $200M by acting now rather than waiting?

JRB: One possibility for that is

Randgold Resources Ltd. (GOLD:NASDAQ; RRS:LSE). It has no debt and has been the best large gold miner over the last decade. Randgold has four producing mines and $500–700M in capital available to make acquisitions. There are many excellent targets in West Africa, so long as the Ebola situation doesn't spiral out of control there.

Another possibility, this one on the royalty/streaming side, is

Franco-Nevada Corp. (FNV:TSX; FNV:NYSE). The company is so well capitalized and has been making a ton of deals over the last 12–18 months. Franco is making money and adding more streams and attributable production. Its stock has held up really well in a difficult time.

TGR: With Franco buying all these streams, it's building in a lot of leverage to a high gold price, correct?

JRB: Absolutely. The one thing with Franco is that it tends to outperform at the very end of bear markets and then at the beginning of bull markets. This is a stock that should continue to perform really well, and if gold goes up, as I believe it will, it will benefit greatly, as will its partner companies. A higher gold price means that Franco won't have to worry about its partners getting into trouble.

TGR: Is there any particular event that investors should look for in the next couple of months to demonstrate that the worm has turned and that we're definitely into another bull market?

JRB: One thing investors should follow is the gold/S&P 500 ratio. Over the last 3.5 years there's been a severe negative correlation between these two asset classes. Money has for years flooded into the broader equities markets but not into precious metals. Right now, money is still flooding into equities generally but is exiting gold.

I think it's possible over the next couple of months we could see a potential blow-off move in the S&P 500. And if the gold/S&P 500 ratio rebounds significantly thereafter, that would be quite a signal. Another event would be gold falling to $1,000/oz and then making a monthly close above $1,200/oz. That would demonstrate to me that we're in a new bull market.

TGR: Jordan, thank you for your time and your insights.

Jordan Roy-Byrne, CMT is a Chartered Market Technician and member of the Market Technicians Association. He is the publisher and editor ofTheDailyGold Premium, a publication that emphasizes market timing and stock selection for the sophisticated investor, as well as

Jordan Roy-Byrne, CMT is a Chartered Market Technician and member of the Market Technicians Association. He is the publisher and editor ofTheDailyGold Premium, a publication that emphasizes market timing and stock selection for the sophisticated investor, as well as TheDailyGold Global,

an add-on service for subscribers that covers global capital markets. Roy-Byrne's work has been featured in CNBC, Barron's, Financial Times,

Alphaville, Kitco and Yahoo Finance. He is quoted regularly in Barron's.

Roy-Byrne has been a speaker at PDAC, Cambridge House and Hard Assets conferences. TheDailyGold.com was recently named one of the top 50 Investment Blogs by Daily Reckoning.

20:01

20:01

Unknown

Unknown