Summary

- The Yen has undergone a massive devaluation against the dollar in recent years

- US and Japan interest differentials suggests the Yen slide may reverse course

- A Yen rally could cause stocks to falter and gold to shine in 2015

Since late 2012, the Yen has fallen nearly 40% as the Bank of Japan

(BOJ) has launched an all-out war to devalue its currency. The forces

that would likely drive this push were no mystery. As outlined on

Financial Sense in June 2012 (see

Massive Japanese Debt Monetization Is Coming, Yen to be Devalued),

Japan's ticking time bomb of debt was coming head to head with its

demographic time bomb, which forced the BOJ to act. This can be seen in

the handoff below as aging Japanese citizens began to sell their debt

holdings while the BOJ ramped up.

Source: Bloomberg

The launch of quantitative easing (QE) in Japan late in 2012 opened

the door for the yen-carry trade to be revived again as the following

article from early 2013 highlights:

Remember the Yen Carry Trade? Well, It’s Back

As confidence returns to global markets, investors appear to be using

the cheap yen once again to fund investments in risky assets — a trade

that is likely to give the battered Japanese currency another boot lower

in the months ahead, analysts said…

This backdrop coincides with a sentiment shift in financial markets, with investors increasingly moving into more risky assets.

"The yen is regaining its ground as a funding currency," said Jesper

Bargmann, head of G11 currencies at Royal Bank of Scotland in Singapore.

"Sentiment has changed in markets, pretty much since January 1. Risk

appetite has returned, there's increased confidence and a search for

yield, so the yen seems to be suffering as a result of that," he said…

A carry trade is when investors borrow in a low yielding currency,

such as the yen, to fund investments in higher yielding assets somewhere

else…

A weakening currency is central to the carry trade since it means

that investors have less to repay when they cash out of the trade.

I don’t believe it is just coincidence that the USD surged relative

to the Yen late in 2012 to early 2014 at the same time the U.S. stock

market soared as shown below.

Source: Bloomberg

Given the rather dramatic decline in the Yen relative to the USD over

the last two years, it makes sense to reevaluate how much more downside

the Yen has and what the implications would be should the Yen rally in

2015. One way to analyze currency movements is based on interest rate

parity (

click for definition)

in which currency exchange rates should move in line with the

differential between country interest rates. As shown below, this theory

more or less works in which the USD/JPY exchange rate tracks the

difference between US 10-yr interest rates and Japanese 10-yr interest

rates. However, there are times when the two diverge and these large

divergences eventually get unwound rather sharply (see yellow shaded

boxes below). We’ve seen three cases in recent years with one in 2010,

2011, and one in 2013. In all of these the JPY/USD exchange rate got the

direction right and the interest rate differential played catch up. We

are currently experiencing our fourth major divergence in recent years

in which the USD has rapidly appreciated relative to the Yen and yet US

long term interest rates have not risen relative to Japan; in fact, the

interest rate differential has declined (see red shaded box).

Source: Bloomberg

This divergence can be unwound by the Yen rallying relative to the

USD and the USD/JPY exchange rate falls, or US long-term interest rates

can rise relative to Japanese to close the gap. Which event occurs in

the months ahead (yen rally or US interest rates rally) will have very

different outcomes for the market. If the Yen rallies and the USD/JPY

exchange rate falls the Yen-carry trade will start to unwind and with it

one element of market liquidity. As shown above, when the USD rallies

relative to the Yen we tend to see strong U.S. stock market returns and

so if the USD falls relative to the Yen we could see some market

weakness ahead. In fact, if the Yen should decline we would be

witnessing a backdrop that we haven’t seen since 2012: no QE from the

U.S. Fed and a strong Yen—two major liquidity supports for U.S.

financial markets for the last two years.

We’ve seen how QE has tended to float the U.S. stock market higher

and when QE was turned off the stock market would stumble. However, the

Fed embarked an open-ended QE late in 2012 such that QE was running for

all of 2013 and the bulk of 2014 and coincident with this time frame was

a massive devaluation of the Yen. The S&P 500 soared during these

times in which both added liquidity to the system, which is shown by the

green shaded regions below while the yellow regions show only an

expansion in the Fed’s balance sheet. We’ve had a lot of stimulus over

the past two years coming from Fed's QE and the Yen-carry trade. We know

the Fed's QE is over and should we also lose the Yen-carry trade we

could be in store for a bumpier ride than we’ve seen recently.

Source: Bloomberg

As mentioned above, the divergence between the USD/JPY exchange rate

and the interest rate spread between the US and Japan can be resolved in

two ways and my inclination is that we see the USD weaken relative to

the Yen in the weeks and months ahead. Why? One reason, as shown above,

is that the USD/JPY exchange rate is bumping up to resistance at the

~$120 level, which is the 2005-2007 resistance zone. So, from a

technical standpoint it’s hard to see the USD appreciate further without

some digestion and consolidation.

Secondly, from a purchasing power parity perspective (

click for definition)

the Yen is at its cheapest valuations relative to the USD since the

middle 1980s. Using Bloomberg’s purchasing power parity function with

the Consumer Price Index (CPI), Producer Price Index (PPI), and the

annual OECD estimates, the Yen is between 15% to 34% undervalued

relative to the USD. Given the multi-decade lows in Yen valuations, a

further depreciation of the Yen appears unlikely.

Source: Bloomberg

Source: Bloomberg

Source: Bloomberg

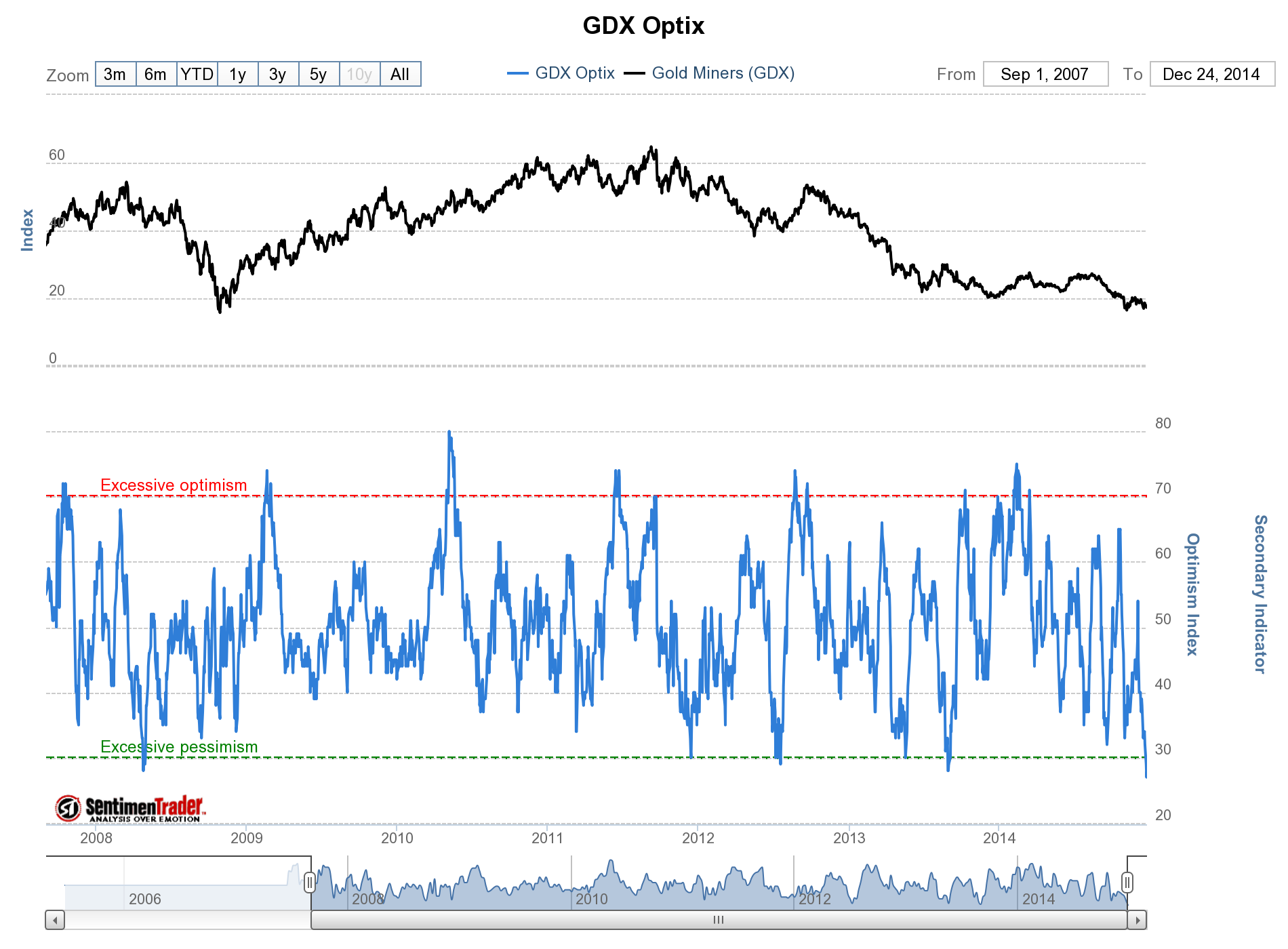

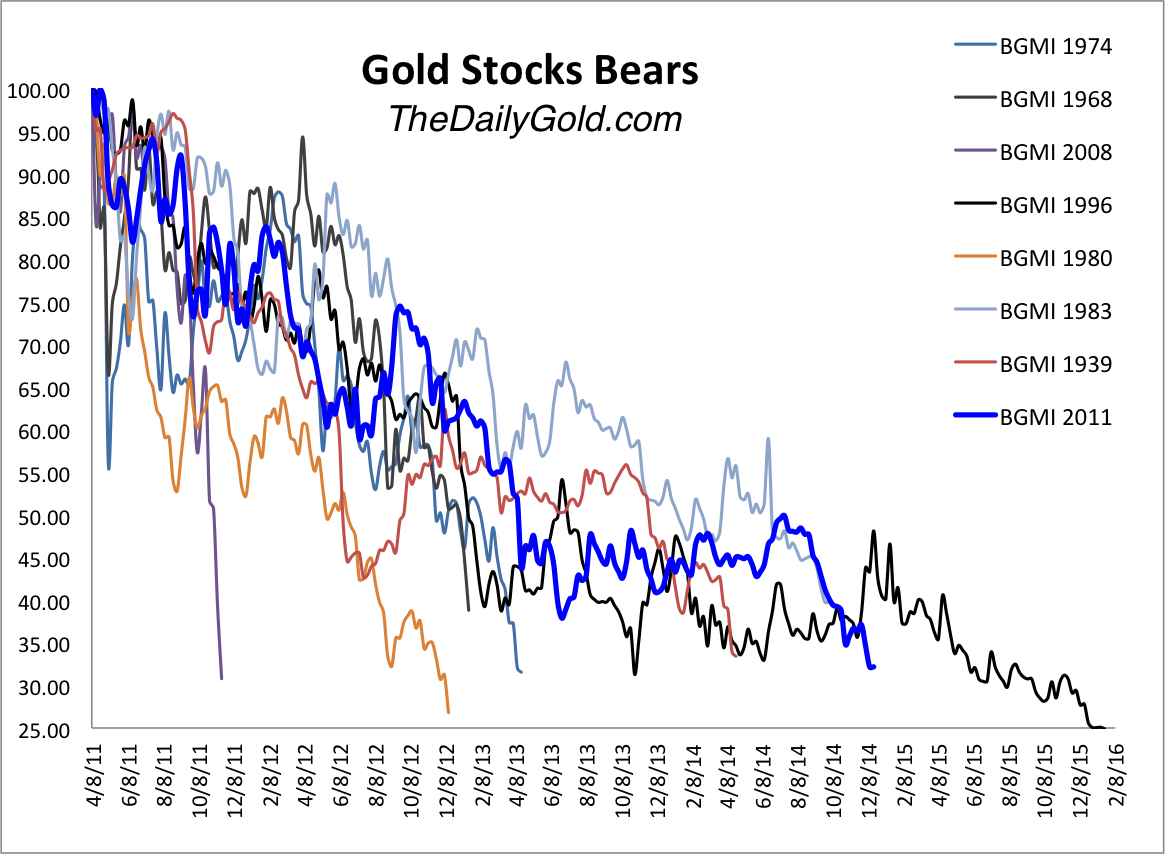

Assuming for the sake of argument that the Yen does cool off in early

2015, what can we come to expect? As mentioned above, the Yen-carry

trade has been associated with positive stock market returns and so an

unwinding of the Yen-carry trade in which the Yen appreciates relative

to the USD could see a weaker stock market, particularly coupled with

the removal of US QE. Secondly, we could also see a pick up in overall

investor anxiety in which safe haven assets like gold benefit. Both the

Yen and gold peaked in 2011 and accelerated their down falls late in

2012. Should we see stabilization in the Yen ahead we could see stronger

gold prices in 2015.

Source: Bloomberg

Also associated with Yen strength is a pickup in volatility as the

Yen-carry liquidity tide goes out. This is shown below with the USD/JPY

exchange rate shown inverted along with the Volatility index (VIX) with

periods of Yen appreciation shown by the yellow shaded regions.

Source: Bloomberg

Summary

In my last article (

click for link)

I made the case that the U.S. was not at risk of slipping into a

recession and the hallmarks of a bull market top were missing and thus

argued the weakness experienced in December was a buying opportunity.

The market has since rebounded sharply in recent days and looks like it

will experience the seasonal Santa Claus rally into year-end and we

could see some strength spill over into 2015.

While I still do not see the signs of a recession or a bear market on

the horizon that is not to say we can’t see a pickup in volatility or

market gyrations in the year ahead. In fact, I think the most bullish

theme one can be on in 2015 is a pickup in volatility with the removal

of QE and a possible Yen-carry trade unwinding.

As highlighted in this article, there is a large divergence between

the USD/Yen exchange rate and their associated interest rate

differentials and my belief is this divergence will be resolved by the

USD weakening relative to the Yen in the weeks and months ahead. Should

this occur we could see a rough start to 2015 with stocks weakening

while gold rallies. The biggest theme I see for 2015 is a pickup in

volatility and the best advice for that kind of climate is to stay

humble as the market whips around here and there and confuses bulls and

bears alike, and to stay nimble as market volatility always creates

opportunities.

21:38

21:38

Unknown

Unknown