Analysts Expect Gold To Remain Strong Ahead Of ECB Volatility

By Neils Christensen

Safe-haven

demand helped gold prices end the week at its highest level since

early September and according to most analysts, ongoing volatility

should continue to support gold in the upcoming shortened trading week.

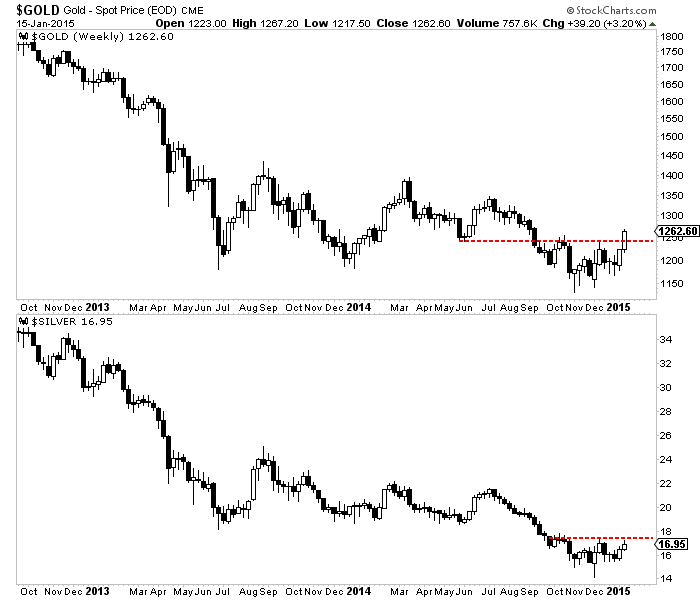

Open floor trading of Comex February gold futures settled Friday at $1,276.90 an ounce, up $53.90 or 4.41% since Monday.

The strong move in gold also helped to drive up

silver prices as Comex March silver futures settled the week at

$17.750 an ounce, up $1.255 or 7.61% since the start of the week.

Although U.S. markets are closed Monday in

celebration of the Martin Luther King Jr. holiday, volatility will

likely pick up Tuesday where it left; analysts anticipate that markets

will continue to recover from the aftermath of the Swiss National

Bank’s sudden decision to discontinue the currency peg against the

euro, analysts said.

Traders and investors are also look

forvolatility to remain high as speculation surrounding Thursday’s

European Central Bank monetary policy meeting continues to grow.

“The rollercoaster ride is far from over… as

upcoming ECB QE will refocus the spotlight on the monetary policy

divergence themes, likely continuing to place stress on US markets as

global investors reposition,” said Gennadiy Goldberg, U.S. strategist

at TD Securities.

According to some analysts, markets have priced

in a 75% chance that ECB President Mario Draghi will announce an

expanded quantitative easing that include the purchase of sovereign

bonds.

Bill Baruch, senior commodity broker at

iiTrader, said the key will be in the details of the program, which he

added will probably disappoint the market’s high expectations.

“I think the risk is that the ECB

under-delivers. It is going to add uncertainty to the marketplace, and

gold is going to look attractive,” he said.

Although Baruch didn’t give a time-frame, he

said that with gold’s current momentum, he expects to see prices test

the next key psychological area of $1,300 an ounce.

“The path of least resistance for gold is higher,” he said.

Axel Merk, president and chief investment

officer of Merk Investments, said that nobody really knows what Draghi

is going to do and that uncertainty is going to help gold in the

near-term.

He added gold should still perform well after

Thursday’s meeting because markets will then focus on the Federal

Reserve’s monetary policy scheduled the following week on Jan. 28.

“The Fed has been fairly quiet with their

optimism. Everyone thinks they are going to move forward with a rate

hike but I’m not so sure,” he said. “Real interest rates are negative

right now and gold will do well in this environment. I am happy with my

gold positions.”

Ken Morrison, editor of online newsletter

Morrison on the Markets, said that he is not convinced that gold will

be able to maintain its momentum.

He added that the gold price has hit and taken

out his near-term target of $1,250 an ounce and that he would expect to

see some profit taking next week.

“If I were long gold at these levels, I would be looking at taking some of my profits off the table,” he said.

One of the reasons why gold has rallied is

because of the anticipation of looser monetary policies in Europe;

however, with the decision already priced in, he would expect to see a

sell-off on the actual event, Morrison added.

Turning to American markets, U.S. data reports

are relatively light until mid-week, with the release of housing data;

the week ends with an early view of the manufacturing sector, which

thanks to recent regional reports, is fairly mixed.

Looking at housing starts, which will be

released Wednesday, economists at Nomura said that they are on pace to

beat 2013 numbers but construction is still down by historical

comparison.

They add “there is still a long way to go in the housing market recovery.”

19:39

19:39

Unknown

Unknown